Total Administrative Services Corporation

Who we are

As the nation’s largest privately held third party benefits administrator, TASC has a mission to improve the health, wealth and well-being of its customers, employees, and communities.

With more than 1,000 lives impacted by TASC employment annually, TASC is able to serve businesses of all sizes across every state in the US.

We are proud that our employees represent more than 7,400 years of experience in the benefits industry and our average employee tenure is 66% higher than the national average.

We handle employee benefits and compliance administration for companies of all sizes. From healthcare to lifestyle, from giving to education, from compliance to continuation – we offer more than 50 benefit accounts and compliance offerings to meet your needs whether you have 1 employee or 1 million.

Our Mission

Improve the health, wealth, and well-being of our customers, employees, and community.

Our Vision

We are a driven and visionary company, setting goals and the steps to reach them.

- Help people by making benefits feel like benefits with our innovative financial services solutions for businesses of all sizes.

Our Values

Our values define our attitudes and behavior to reflect what truly matters to us.

How We Tick

- Innovative Agile Mindsets - Striving to be creative and nimble in our work and our points of view.

- Fun & Caring Community - Advancing a professional, inclusive work environment that encourages fun and philanthropy.

- Mutual Respect & Recognition - Valuing the contributions, opinions, and inputs of employees and customers.

How We Work

- High Performance Growth - Achieving extraordinary outcomes through the extraordinary contribution of employees.

- Right-Touch Customer Experience - Enabling our customers to select the nature and the frequency in which they interact with us, allowing them to make the most out of our relationship.

- Efficient & Financially Accountable - Developing solutions that streamline processes and produce more efficient and effective outcomes for our customers and us.

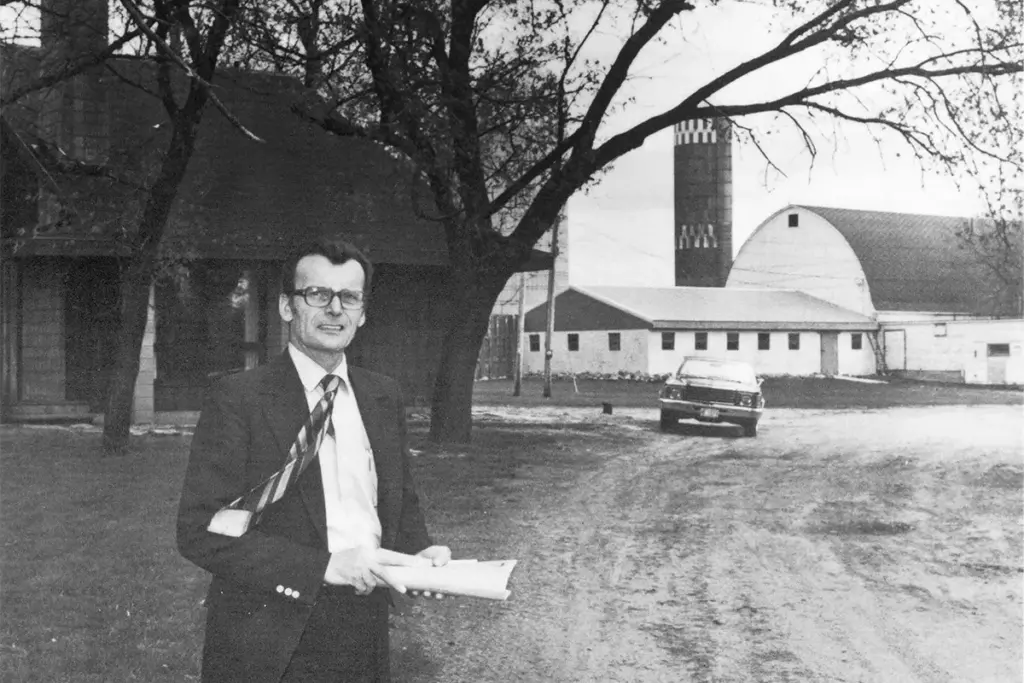

We started with a desire to help a friend

Our story

In 1975, our founder discovered an easy way for regular people to receive the tax advantages of large corporations. In the process, he brought simplicity to one of the most complicated systems in the world: the US tax code. His solution worked so well, he continued to invent products that transformed the lives of farmers and other entrepreneurs, their families, and their communities. Total Administrative Services Corporation has grown from one entrepreneur to an organization that impacts the employment of 1,000 lives annually

Over the years, unpredictable rules and legislation, and hundreds of products from hundreds of companies, have brought complexity and confusion to an industry that began with the intention of simplicity.

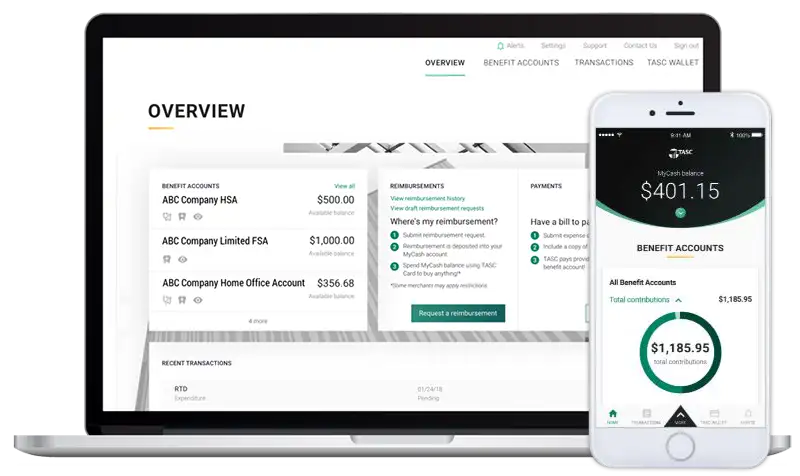

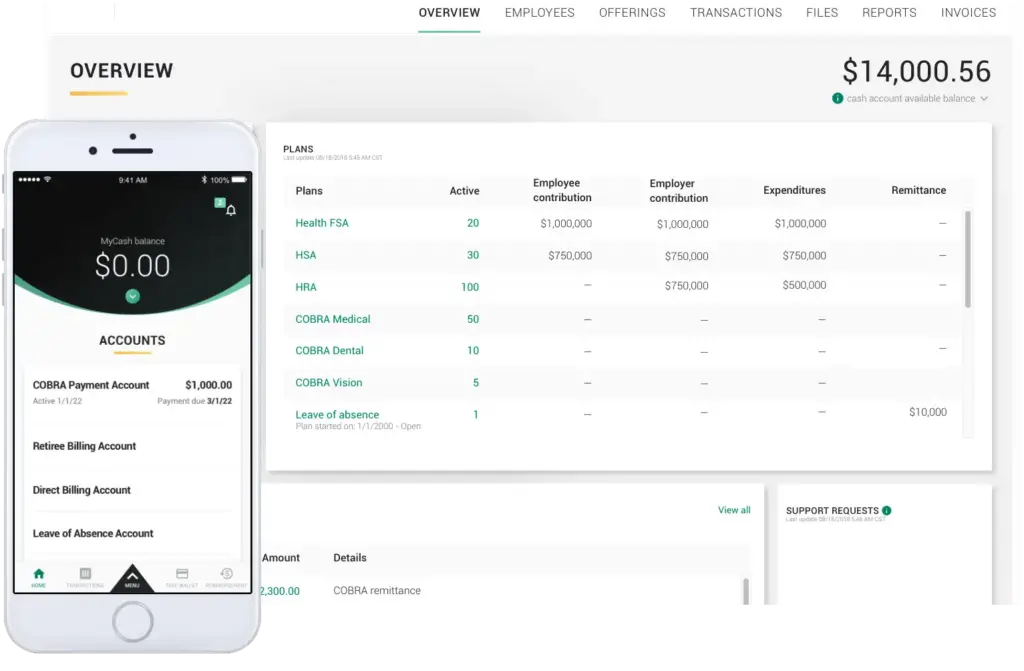

We’ve embraced this challenge and discovered a new way to remove complexity, a new way to help Americans pay less tax and invest more in their health and prosperity. We have built the smartest, most intuitive, most secure way to deliver benefits—from the ground up.

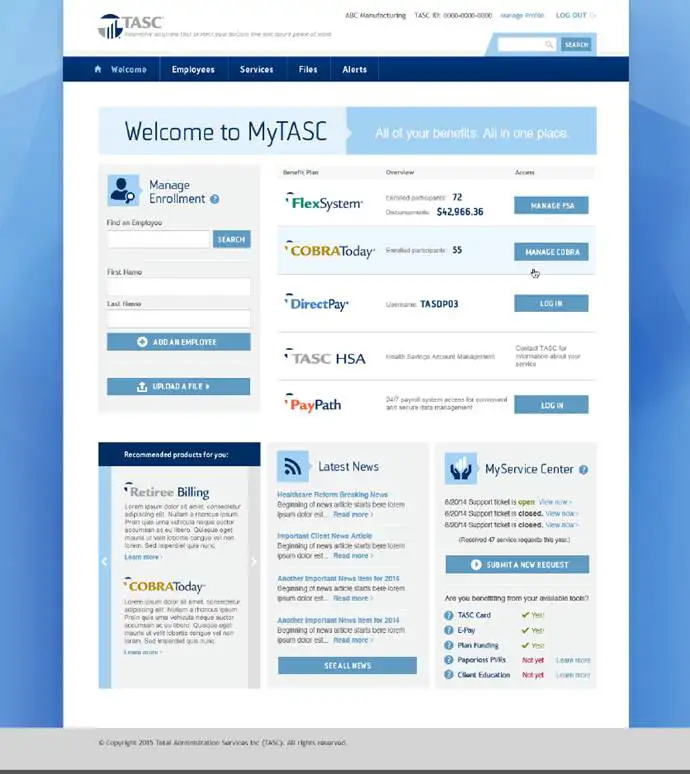

We’ve harnessed technology and service like no one else in health and welfare: we have integrated all employee benefits in one easy-to-navigate place. Our clients will be secure. They will be compliant. When legislation changes, it’s our job to help them figure it out. TASC is committed to understanding our clients’ needs and ambitions and will configure a solution, whether they have one employee or one million.

Continuous Improvement Year After Year

Our history

2010

Launch of TASC Card & Expansion of Compliance Services

2011

First Benefit Card with Cash Account (MyCash) & Launch of MyTASC App

2014

Launch of OneTASC & Expansion of Benefit Offerings

2015

40th Anniversary & Partnership with The Give Back Foundation

2019

Launch of TASC Universal Benefit Account