Total Administrative Services Corporation

Everyday products that qualify

As of January 1, 2020, over-the-counter (OTC) medicines as well as feminine care products are eligible for tax advantaged benefit plans such as FSAs, HRAs, and HSAs without a prescription or physician’s note. In addition, there are hundreds of everyday eligible expenses FSA, DCFSA, HSA, HRA participants can purchase using pretax dollars to reduce their taxable income. Plus, participants can use their TASC Card® to pay for eligible expenses at the point of purchase instead of paying out-of-pocket and requesting reimbursement. Check out our list of resources below.

Use your TASC Card to pay for healthcare-qualified expenses at clinics, optometrists, dentists, pharmacies, and other merchants with a healthcare inventory information approval system (IIAS) in place. It may also be used for some daycare and transportation account expenses.

FSA, HSA, HRA Eligible Expenses

HSA Eligible Expenses

FSA Eligible Expenses

Letter of Medical Necessity (LOMN)

Dependent Care FSA Eligible Expenses

HRA Eligible Expenses

Funded HRA Qualified Expenses

AgriPlan and BizPlan Eligible Expenses Guide

Check eligibility at

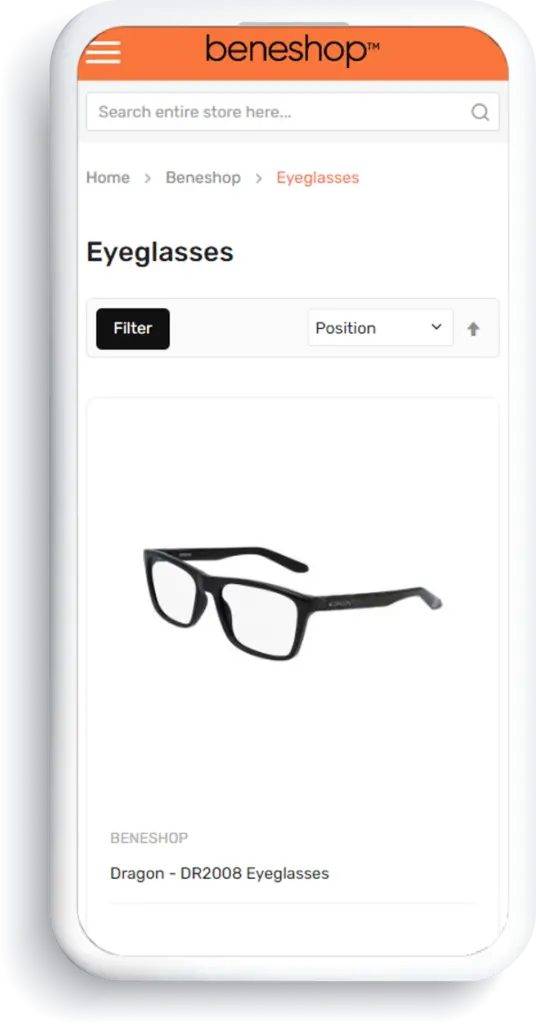

Beneshop makes shopping for healthcare products easier by providing a wide variety of products, brands, and retailers covered under your FSA plan.